5 Minute Scalping Strategy With Magic Indicator

Scalping Is Valuable Technique In Volatile Market

Here is just one technique using a favorite indicator. We will provide more in other videos.

https://youtu.be/Viij9NvnobM

5 Minute Scalping Strategy – This MAGIC INDICATOR is a GAME CHANGER

1,864 viewsMay 9, 2022

24.3K subscribers

5 Minute Scalping Strategy – This MAGIC INDICATOR is a GAME CHANGER This 5 minute scalping trading strategy will blow your mind at how accurate the buy sell signals are for crypto, forex, and the stock market. 🤑Follow ALL of my Trades – Join My Patreon ➡️ https://www.patreon.com/MyTradingJour… 🤑Follow my FREE weekly Trade – Join My FREE Telegram Channel ➡️ https://t.me/joinchat/AAAAAFcSSyCUKI3… 📈Want to make more WINNING trades? Get the BEST trading indicator here: https://bit.ly/3nS3DaT 🚨 👇👇👇Subscribe to this channel here: 👇👇👇🚨 ✅ https://bit.ly/2yS9uZo 5 minute scalping strategy 5 min scalping strategy 5 minute scalping indicator 5 min scalping indicator best 5 minute scalping strategy best 5 min scalping stategy how to scalp 5 minute chart how to scalp 5 min chart Best scalping Strategy best scalping strategy forex scalping strategy 5 min scalping 1 min scalping strategy 15 min scalping 15 min scalping strategy 1 min scalping forex 5 min scalping forex forex scalping strategy forex – Disclaimer – This video expresses my personal opinion only. Trading financial markets involves risk, and is not suitable for all investors. I am not responsible for any losses incurred due to your trading or anything else. I do not recommend any specific trade or action, and any trades you decide to take are your own.

PRIMEXBT (CRYPTOGRIZZ TRADER)

[the_ad id=”3553″]

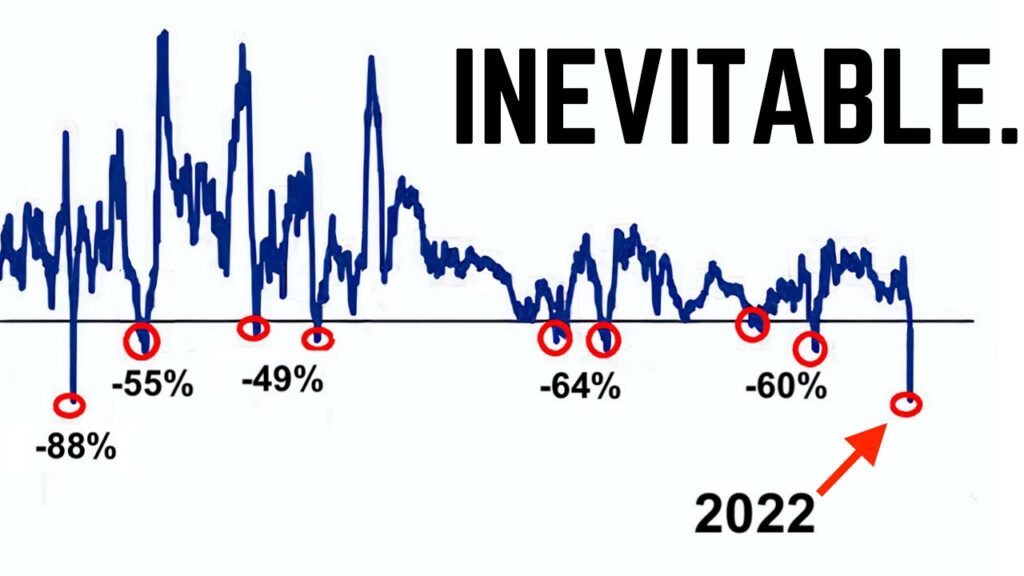

PROFIT FROM THE COMING STOCK MARKET MELTDOWN BY USING PRIMEXBT TO SHORT THE NASDAQ AND S&P 500 USING LEVERAGE

Read More: Profit From Stock Market Meltdown

[the_ad id=”3552″]

[the_ad id=”3553″]

5 Minute Scalping Strategy With Magic Indicator

VISIT OUR OTHER SITES:

Check Out Our Crypto Privacy Site: CryptoGrizz.com

Check Out Our Crypto Trading Site: CryptoGrizzTrader.com

Check Out Our Low Cap Altcoin Site: CryptoGrizzAltcoins.com

Check Out Our Prepper Site: PrepperGrizz.com

Check Out Our Prepper Survival Site: PrepperSurvival.org

Check Out Our Global Crypto Survival Site: GlobalCryptoSurvival.com

FULL VIDEO TRANSCRIPT

0:00

what’s going on everybody yeah welcome

0:02

back to my trading journey in today’s

0:04

video

0:05

i am going to be showing you guys an

0:08

awesome indicator strategy for scalping

0:12

so scalp and trading it’s it’s become

0:14

very popular and i’ve been getting a lot

0:15

of requests

0:17

about you know making some videos on

0:19

shorter time frames so this is going to

0:20

be on a five minute time frame uh great

0:22

for scalping forex great for scalping

0:25

you know crypto like ethereum bitcoin um

0:28

this is also great for scalping the

0:30

stock market and and a lot of the

0:32

trading that i do is is in the u.s stock

0:35

market so i’m going to be showing you

0:37

examples and how to set this up using

0:39

the qqq uh

0:41

as an example the nasdaq

0:43

uh five minute chart and uh yeah let’s

0:45

let’s get right back into it before i

0:47

get started i always have to say right

0:48

this is not financial advice i’m not a

0:50

financial advisor this is for

0:51

educational and information purposes

0:53

only so

0:55

uh let’s get into it so there’s going to

0:58

be two indicators that we’re going to be

0:59

using for this and i’m also going to

1:00

teach you guys

1:02

you know where to put your stop-loss

1:04

where to take profit how to set those up

1:06

as well as wait till the end of the

1:08

video watch till the end because towards

1:10

the end i’m also going to show you how

1:11

to set up indicators

1:13

and alerts

1:14

where

1:15

it gives you you know you when it gives

1:19

you a buy or sell

1:21

alert

1:22

you know exa you know you’re not just

1:24

watching your charts all day long and

1:26

you get alerted with that kind of stuff

1:28

so i’ll show you guys how to set up

1:29

alerts on this as well

1:31

and then we’ll backtest it a little bit

1:33

i’ll show you guys a few examples and

1:35

you know you guys can

1:37

drop a comment let me know what you guys

1:38

think

1:39

all right so let’s get back into it

1:41

let’s uh let me go ahead and stop the

1:43

replay mode

1:46

and let’s go back

1:48

to

1:49

a live market so here’s the live market

1:51

right now right

1:52

so there’s gonna be two indicators

1:54

you’re gonna be using this one the l

1:56

superior kaufman adaptive ma and an ift

1:59

combo i’ll show you guys exactly how to

2:01

set both of these up and the ch and the

2:03

settings to change on these

2:06

so when you first log into trading view

2:08

and this is one of the best buy sell

2:10

indicators on trading views so you guys

2:12

definitely need to check this out

2:15

let me just x out all of this stuff so

2:17

you guys see exactly what your chart is

2:18

going to look like when you log into

2:20

trading view so the first

2:22

indicator that you’re going to add

2:24

you’re going to go into indicators

2:26

type in l2

2:28

perry

2:30

and this is going to be the one the l2

2:31

perry kaufman adaptive m a right

2:34

so you’re going to add that

2:37

x out

2:38

go into the settings

2:41

and go into input

2:43

and change the period f from 13 to 11.

2:48

okay the next indicator that you’re

2:51

gonna add

2:52

is called you’re gonna type in

2:55

combo

2:57

sto

2:58

plus

3:01

rsi and this is the one that you’re

3:03

going to use the inverse

3:05

fischer transform combo sdo plus rsi

3:09

okay

3:12

once you do that

3:14

now what exactly are we looking at what

3:17

exactly is

3:19

the uh confirmations and and trade

3:22

signals and stuff like that right that

3:24

that are pretty decent to follow

3:27

so

3:28

the way this this is going to work is

3:30

you want to make sure you you get you

3:32

get like a buy or sell signal so for

3:33

instance this was the i guess this was

3:35

the last time that sell signal was

3:36

alerted

3:37

right because this this right now is the

3:39

current market while the market’s open

3:41

right now

3:42

so when you get a sell signal you want

3:44

to the first thing for confirmation is

3:46

you got to make sure that the candle if

3:48

you’re going short on a position it’s

3:50

red not green okay

3:52

and

3:53

you want the ift combo right here to be

3:56

oversold below the green line if it’s

3:59

going to be a cell if it’s going to be a

4:01

buy i’ll show you an example of that too

4:04

right

4:05

this one was a this one will be a lot

4:07

would would be a loss so we’re not going

4:08

to look at this one

4:10

but if you want you know if you’re going

4:12

for by position you want to get a buy

4:14

signal

4:15

you want the candle to be green and you

4:17

want it to be overbought so you want it

4:19

to be above the red line and then i’ll

4:21

i’ll show you guys where to put the stop

4:23

losses and stuff like that so you guys

4:25

get a better idea as well

4:27

so

4:29

so with this

4:31

you all of this stuff lines up and then

4:34

the way you’re going to do stop loss and

4:35

take profit on these or this is what i

4:37

like to do

4:39

is put the stop loss right at the line

4:41

right right at the intersection line

4:43

where you’re getting that buy sell

4:45

signal right

4:46

and then i like to go on this particular

4:48

scalping strategy

4:50

i like to go for a two to one profit so

4:53

if i’m risking 100 i want to make 200

4:55

right

4:56

and that’s that’s the you know and i’ll

4:58

show you guys some some data on like the

5:00

last few trades as well on this

5:02

and this this works great

5:04

again like i said with scalping forex

5:06

scalp and crypto scalping you know the

5:09

u.s stock market all of that stuff

5:12

um

5:13

so now let’s let’s look let’s look at

5:15

some trades i’m not going to make this

5:16

video too long because then i want to

5:17

show you guys how to set up the alerts

5:18

as well so let’s let’s take a look at

5:20

you know like maybe four or five

5:22

examples

5:23

and then i’ll show you guys how to set

5:25

up the alerts

5:26

so on something like this so let’s take

5:28

a look at this example so this would

5:30

have been a trade

5:32

dude

5:34

keep pressing the wrong button

5:36

and do a short position so say you got

5:38

in over here you’re gonna put your stop

5:40

loss right at the line

5:43

okay

5:44

and then let’s do two to one right

5:47

so

5:50

there you go

5:52

there you go this this one would have

5:53

been a win it would have it would have

5:54

hit right there right when the market

5:56

opened

5:59

this one

6:00

i can already tell this one will be a

6:02

loss but i’m still gonna show you guys

6:04

not every trade is a win and as a trader

6:07

you have to learn that not every trade

6:09

will be a win

6:12

you have to learn to take your losses so

6:13

yeah this one would have hit us hit a

6:15

stop loss

6:17

let’s go back

6:18

let’s look at the

6:20

all right so this will be the third

6:22

trade

6:23

sell signal

6:26

red candle which is great

6:28

and when you’re on that

6:30

it’s oversold great so this will be

6:35

this would be a trade

6:37

stop loss would be right here at the

6:39

line

6:40

we’re gonna do two to one

6:45

right

6:47

yep there we go it would have

6:50

the take profit

6:51

would have hit right there

6:53

all right

6:56

let’s look at another one

6:58

here’s the

6:59

next one

7:00

that was this will be a long position

7:02

you get a buy signal candle is green

7:05

it’s overbought

7:08

long position you get started right

7:10

there

7:13

stop loss will be at the line

7:16

we’re going to do two to one

7:19

so take for risk to reward will be two

7:23

there we go cool what a hit right there

7:26

that would have been a win

7:28

let’s look at one more

7:32

and oh see this is great this this will

7:34

also the last two will also show you

7:36

guys how trades become invalid okay so

7:38

let’s let’s go through this one first

7:41

so this will be a short position because

7:43

you get a sell signal it’s red and it is

7:45

oversold

7:47

so you get in

7:51

the

7:51

the line the cro intersection will be

7:54

your stop loss

7:56

we’re gonna do

8:00

say two to one

8:08

come on

8:10

all right i’ve gotten on this trade

8:13

right here

8:20

there you go

8:21

all right so this would have hit

8:23

take profit right there

8:26

before it started going back up

8:28

all right now this is how

8:31

this is how this stuff becomes these

8:33

trades become invalid

8:35

yeah you’re getting a buy signal and

8:37

it’s overbought but it’s a bearish

8:39

candle it’s not a green candle so you’re

8:41

not going to take this trade

8:42

same thing over here

8:44

you’ve got a sell signal

8:47

but it’s a bullish candle you’re not

8:48

going to take this trade so this makes

8:50

it invalid

8:52

so for instance with these things that

8:54

we went over

8:55

one two three

8:57

oops

9:00

whatever you guys saw what that was

9:03

all right

9:05

there we go

9:07

nope

9:08

it was right here

9:10

all right so one

9:12

two three

9:15

four five we went through five examples

9:18

one was a loss so 80 win rate of the

9:20

five you know out of the last five

9:22

trades so even if you’re risking a

9:24

hundred dollars to make 200

9:26

you know you make you make 800 you lose

9:28

a hundred dollars you’re still up 700

9:31

off of off of five trades

9:33

i think i think that’s great so again

9:35

you know you got to pick and choose your

9:37

your positions but at the same time you

9:39

have to follow these rules

9:41

and you know it’s i’m glad that we kind

9:43

of ran into

9:44

this man i keep moving this

9:47

all right anyway i’m going to delete

9:48

these anyway

9:51

so

9:52

you know i’m glad we ran ran into these

9:55

two examples because that shows you how

9:57

a trade is invalidated if not all three

10:00

uh

10:01

you know

10:03

triggers triggers work all three

10:05

confirmations right

10:07

so now let me show you guys how to set

10:10

up the alert so the alerts are going to

10:12

be set up over here in the l2 perry

10:14

kaufman adaptive m a

10:16

so you’re gonna go click on these three

10:18

dots right here where it says more

10:21

add alert

10:23

and right now and then you’re gonna set

10:24

up two alerts so the first alert is

10:26

going you’re gonna click only once or

10:28

once per bar depending if you want them

10:30

over and over and over again

10:32

okay

10:33

once per bar and then alert on long just

10:36

click create once you’re done with that

10:38

go back into

10:40

you know more

10:41

go into alerts and then you’re gonna do

10:44

alert on short and that’s how your

10:46

alerts are going to be set so whenever a

10:48

bar you know

10:49

closes that has that meets that gives

10:52

you a buy signal they’ll alert you and

10:54

this way you guys can see if the other

10:57

you know if it’s a bullish candle

10:59

bearish candle if it’s oversold or

11:00

overbought in the other

11:02

indicator and this way you can make your

11:04

decision if you want to take that trade

11:06

or not okay again now financial advice

11:08

just just for information purposes only

11:11

and if you guys like this video please

11:13

do hit that thumbs up and give it a like

11:15

drop me a comment below subscribe to

11:17

this channel if you guys want more of

11:19

these cool trading strategies

11:21

and also uh join my free telegram

11:24

channel i post about one free trade a

11:26

week on there and if you want to follow

11:28

all of my trades i’ve recently also

11:30

opened up a patreon

11:33

so uh definitely you know check out

11:35

check out the link and these are the

11:37

kind of trades that i’m placing in my

11:39

patreon that

11:40

people are enjoying

11:42

and it’s basically every single trade

11:44

that i make i’ll i’ll post on there on

11:46

the free telegram channel i post like

11:48

one a week but i trade of course a lot i

11:51

make more than one trade a week so if

11:52

you want to check out all my trades

11:54

check out my patreon and uh yeah i’ll

11:57

see you guys on the next one

English (auto-generated)